Yesterday, gold closed at USD 1145, the historical high, and the metal over last 12 months has generated a return of more than 50%, outperforming the broader equity market by more than 18%. The following charts look at relationship between gold price and an index that is proxy for gold price, and also evolutions of these two.

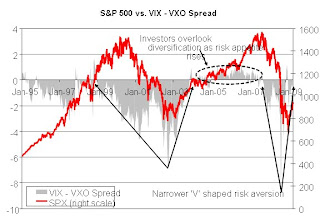

Gold is an asset which is primarily used as a hedge against inflation and also as a hedge against crisis i.e. investors seek gold when the risk averseness increases. On the other hand gold is an anathema during strong growth period. Hence price of gold theoretically should be proportional to risk averseness and inflation, and inversely related to growth. Based on this premise an index as proxy for gold price was devised as follows,

Gold Proxy Ratio Index = (1 + rp) * (1+ Πe) / (1 + ge)

where,

rp - risk premium (difference between SPX’s earning yield and 5 year US Treasury yield)

Πe - expected inflation (breakeven from 5 year Treasury Inflation Protected Securities, TIPS)

ge - expected growth (yield of 5 year TIPS)

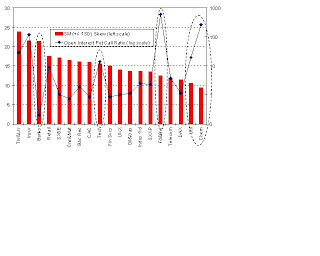

The scatter plot shows that since August the relationship has deviated from the normal course in favour of gold price hinting that the recent run up seen in gold might be a bubble in formative stage. The line chart too shows a considerable divergence between gold price and the proxy.